Case Study: Click2Call Insurance offers for affiliates

In the rapidly evolving digital marketing landscape, the integration of Click2Call technology with insurance offers is emerging as a pivotal strategy for enhancing customer engagement and conversion rates.

This case study delves into the mechanics of Click2Call and its efficacy in the United States’ insurance sector, highlighting its role as a catalyst for business growth and customer satisfaction.

Overview of Click2Call Technology in Insurance Offers

Click2Call technology, a cornerstone in modern communication strategies, particularly shines in the context of insurance offers.

Enabling instant phone connections through a simple click significantly eases the customer’s journey from inquiry to acquisition.

Current Trends in the Insurance Market

The insurance market in the US is witnessing a substantial shift towards digital solutions. Consumers demand quick, easy, and personalized experiences, a need that Click2Call with insurance offers aptly fulfills.

Role of Digital Marketing in Insurance

Digital marketing in insurance is not just about reaching a wider audience but also about enhancing the quality of interaction. Click2Call technology plays an instrumental role in bridging the gap between digital advertisements and personal customer engagement.

Defining Click2Call in the Context of Insurance

Click2Call, in the realm of insurance, is more than just a calling feature; it’s a strategic tool for boosting customer trust and streamlining the complex process of understanding insurance policies.

Optimizing Click2Call with Insurance Offers: Insights from the Insurance Vertical

How does Click2Call enhance the insurance vertical? It simplifies the communication process, allowing potential clients to connect with insurance experts instantly, leading to higher conversion rates and improved customer satisfaction.

Effectiveness of Click2Call in the Insurance Industry

Click2Call with insurance offers is particularly effective because it caters to the immediate needs of the modern consumer. It facilitates a direct and personalized connection, crucial for discussing detailed and often complex insurance products.

Click2Call in Insurance Affiliate Marketing: A Strategic Exploration

The Click2Call format in insurance affiliate marketing offers a unique avenue for engagement and conversion.

This case study, centered around a campaign by EZmob, provides key insights into optimizing Click2Call for the insurance sector, focusing on conversions and conversion rates without delving into specific numerical data.

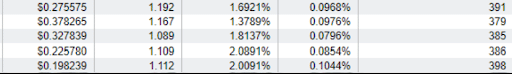

1. Connection Type: Enhancing Conversion Through User Accessibility

The analysis of different connection types, such as cellular and Wi-Fi, reveals their impact on conversion rates. The trend suggests that certain connection types may be more conducive to higher conversion rates, likely due to factors such as user accessibility and browsing behavior.

This insight allows marketers to tailor their Click2Call campaigns to the most responsive connection types, thereby enhancing overall conversion efficiency.

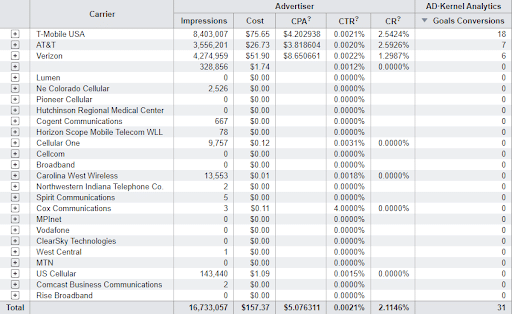

2. Carrier Compatibility: Targeting for Higher Conversion

Different carriers present unique opportunities to reach potential customers.

The study shows that some carriers facilitate better conversion rates for Click2Call campaigns.

This might be due to the demographic or regional preferences associated with specific carriers.

Understanding these nuances can help in crafting carrier-specific strategies to boost conversion rates.

3. Operating System Optimization: Catering to Platform Preferences

Operating systems play a crucial role in user experience and engagement. The campaign data indicates that conversion rates can vary significantly between iOS and Android users.

This variation calls for a more nuanced approach to campaign design, where messaging and user experience are tailored to align with the platform-specific preferences, thereby enhancing the likelihood of conversions.

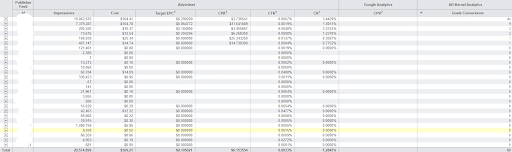

4. Feed and Content Strategy: Maximizing Engagement and Conversions

The study also highlights the importance of feed choice and content strategy in influencing conversion rates.

The effectiveness of different content formats and placements within various feeds can significantly impact user engagement and subsequent conversions.

Marketers must focus on creating compelling, relevant content and strategically placing it in feeds where it most likely resonates with the target audience, thus driving higher conversion rates.

This case study underscores the multifaceted approach needed in Click2Call campaigns within the insurance affiliate marketing space. By focusing on aspects such as connection type, carrier, operating system, and content strategy, marketers can enhance the campaign’s ability to reach the target audience and convert engagements into tangible results.

This strategic approach is critical to harnessing the full potential of Click2Call technology in the competitive insurance market.

Performance Indicators (KPIs) for Click2Call in Insurance

The success of Click2Call in insurance offers can be measured through various KPIs such as call duration, conversion rate, customer satisfaction scores, and more. These metrics provide insights into the effectiveness of the campaigns and areas for improvement.

Conclusion

In conclusion, Click2Call with insurance offers significant advances to the insurance industry. It aligns with the digital age’s demands for speed and efficiency and enhances the customer experience, leading to better conversion rates and customer loyalty. Insurance companies that continue to innovate and incorporate tools like Click2Call will find themselves well-positioned to meet the evolving needs of consumers with unmatched efficiency and effectiveness

Join our Newsletter

Get access to promotions, case studies, and recommended partners